Why You Should Give Automated Crypto Trading a Try

Cryptocurrency trading has become a new trending career choice, popular with those who had enough of office life. However, nearly 40% of new traders quit within a month. Lack of commitment, messy time management, and unrealistic expectations are just a few reasons why people quit early.

The good news is that trading doesn’t have to be all-consuming. If you’re worried that, as a new trader, you will no longer have time to walk your dog or afford a proper day off, that’s definitely not the case. The majority of people in the industry have automated and optimized their routine using crypto trading bots.

What Automated Trading Actually Is?

Automated trading depends on a set of predetermined rules which enable algorithms to enter and exit the market. Basically, it means that you don’t need to open and close your trades manually, the bot will do it for you based on your preferences and market situation. Algorithmic trading is especially relevant for stock exchanges and trades with bigger volume. Recently, it paved its way into the world of cryptocurrency.

In the crypto space, automated trading means using software (crypto bots) that works with signals, various filters, and even technical analysis. Users just have to pick a strategy, set their preferences, and the program will do the rest. The obvious advantages of this trading method include emotionless decision-making and 24/7 operation. In other words, trading bots eliminate the human factor.

As for the other perks of crypto bots, it’s worth mentioning that they can spare you from unexciting manual work and countless daily repetitions of the same actions, such as placing and closing orders and more. Also, bots can save you from making bad decisions fuelled by bad moods and emotions.

Cryptocurrency Bots in Action

Today, there’s no lack of cryptocurrency bots, and most of them will offer you relatively similar functionality (yet, some of them are better than others). These bots collect data from the market via API and analyze it. The goal is to predict future prices and then place buy and sell orders to make a profit. It is considered that the more sources the bot uses, the better the outcome.

You can use trading bots with the majority of mainstream exchanges, etc. HitBTC Crypto Exchange. To enable crypto bot trading, use your exchange to generate API keys and add them to the bot. Then you’ll need to pick a trading strategy, trading pair, and desired position. Later, you will be able to customize advanced settings and tools such as technical analysis indicators or a stop loss.

Although crypto bots do not guarantee an ultimate risk-free trading experience, they can become indispensable helpers when set up and configured correctly.

Setting up a TradeSanta bot in 2022

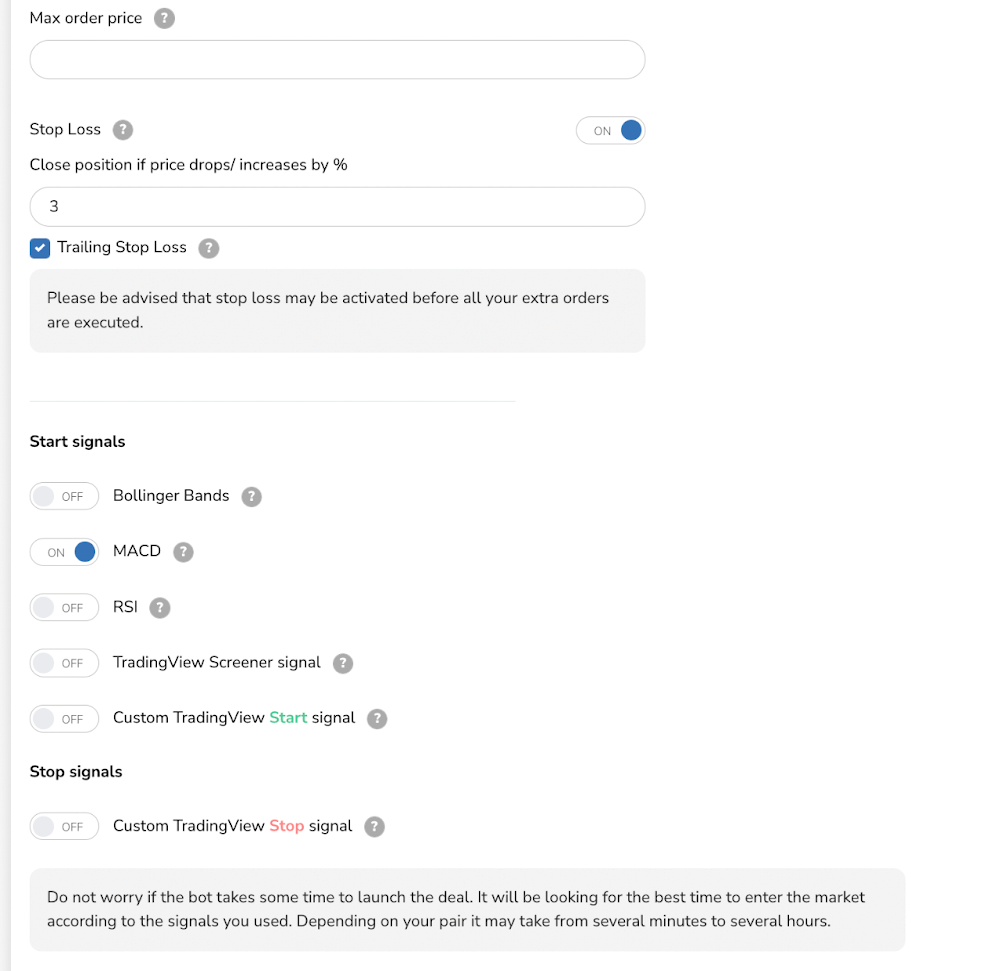

After the initial settings are all up, the platform will link you to the next page with more detailed settings.

Here, you can choose your take-profit target, as well as your trailing take-profit target. In addition to that, you can set up a number of extra orders and order volume.

Do you prefer to use risk-management tools while trading? Just set up a stop loss. For those of traders, who want their bot to use technical analysis, choose which indicators suit you the best.

And that’s basically how a crypto trading bot works. After setting it up once, you will no longer have any problems setting up bots in the future, either from a desktop or your mobile phone!

Why is TradeSanta and HitBTC a Match?

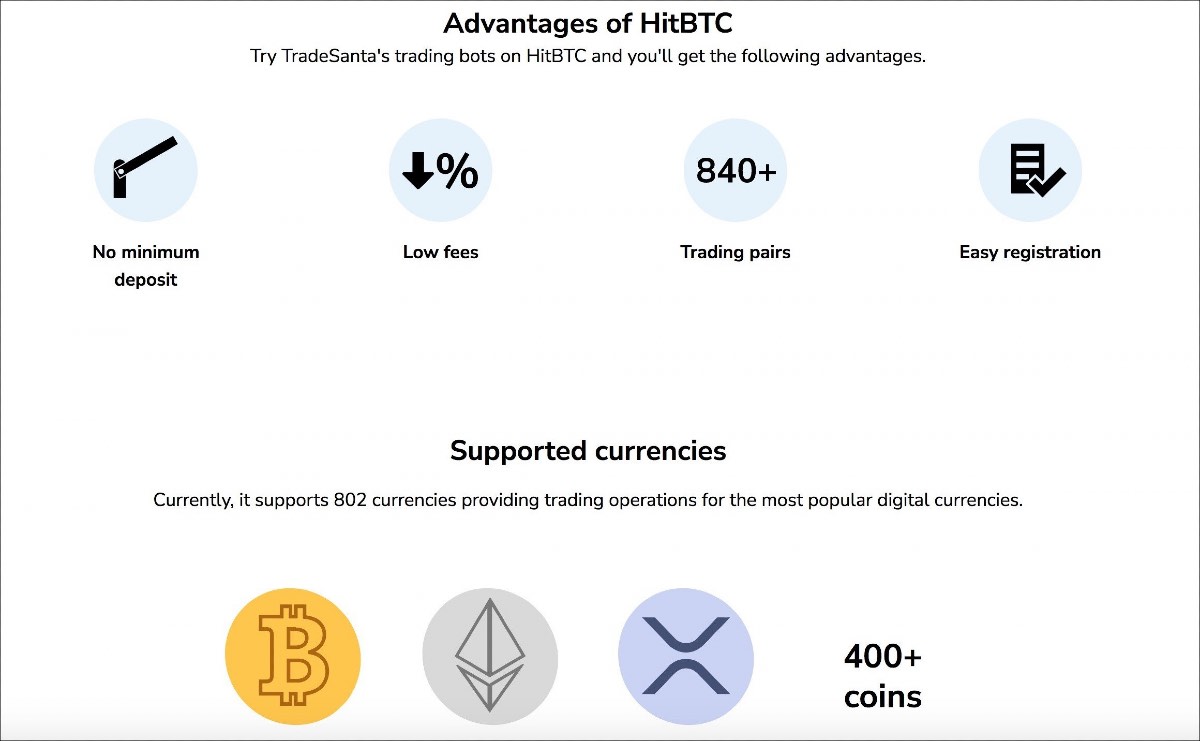

TradeSanta supported trading on HitBTC from the day it was launched. One of the reasons for that is that HitBTC is an adequate playground for the diverse functionality supported by TradeSanta bots.

HitBTC is a veteran crypto exchange operating since 2013. The platform is known for nearly the biggest amount of supported coins on the market. In years, it gained a huge user base and significant trading volume. But what matters more, all the time HitBTC has been adding new features making the exchange suitable for all kinds of traders.

HitBTC allows you to trade using over 10 order types, a feature that helps traders to avoid serious risks. Margin trading, OTC desk, and perpetual futures trading are here, too. TradeSanta bots are capable of working with all of these features which means that they allow you to take the best of HitBTC. So no matter if your main passion is margin trading or you are a spot trading person exploiting immediate-or-cancel too much, you will be able to do your thing on HitBTC using TradeSanta.

More than that, HitBTC hosts trading competitions. In these competitions, you should outperform other participants in the trading volume of a specified crypto coin in a certain time frame. This can be a great challenge for a TradeSanta bot. The winners are rewarded with extra amounts of crypto coins.

Summing up

That said, if you’re thinking of saving yourself some more time and still want to keep your crypto wheel profits rolling, maybe check out crypto trading bots because they can significantly improve your life!

Coming from the Wall Street culture, automated trading slowly transfers to the crypto niche, giving you competitive advantage over other human traders. No need to monitor the market all the time, an increasing number of the deals closed, good health and sleep - these are not even all the advantages of crypto robots.

They are easy, they are smart, and fun - if you use TradeSanta, the very good place to start for a newbie and go on for a professional. Do you want to know more? Shoot all the questions on our socials!

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment