How to Track Crypto Whales?

Although blockchain technology and crypto assets provide another great opportunity for individuals to enter the financial world, some people or organizations have more power and influence than others. We called these people, the Crypto Whales. We will try to explain crypto whale trading activities and how to track whale trades in this article, which may help you optimize your trading strategy.

Who Are Crypto Whales?

A crypto whale means a person or organization that possesses a large number of particular cryptocurrencies. A whale that owns enough cryptocurrencies is able to manipulate the coin or token value. Generally, there is no certain threshold of a person or organization holding tokens or coins to be considered a whale. If you are holding 1000 BTC, people may consider you are a whale. However, for altcoin, the number will be higher, it is basically related to the market value.

Who Are the Bitcoin Whales?

As mentioned above, Bitcoin whales are people or entities that hold enough Bitcoin to influence or even manipulate the Bitcoin price. According to the Bitcoin rich list on Coincarp. Top 100 Holders hold 13.68% of all Bitcoin(about $119bn), especially the top 10 holders, they are controlling 5.35% of Bitcoin. If a Bitcoin whale transfers their Bitcoin, it may cause the Bitcoin price to rise or fall unexpectedly, the consequence is that the Bitcoin price will detach from the underlying fundamentals.

Why Track Crypto Whale Transactions?

- Market Move Prediction

Market liquidity is always related to the market price change. Crypto whales can manipulate the supply of crypto to influence the liquidity and make the market suffer volatility. The purpose of the whales is to increase the value of their digital assets, to make it happen, they could sell a large number of tokens to provoke a wider market sell-off, then they will buy back tokens at lower prices. Also, they can release a large sum of assets to acquire crypto assets to make the crypto assets' price soar and attract retail investors to invest, which will raise the value of their holdings. Because the crypto whales have a large impact on the market price, so the investors want to keep track of their activity and to benefit if the whales' movement happens.

- Get to Know the Market Stage

Bear market or bull market may start alternately since the markets are cyclical. In general, the market price increase in peaks is driven by retail money, however, the market price falls to the bottom is the right time to get in. Crypto whales are an important role who influencing the market trends, although the price change is driven by all the retail investors. To track crypto whales allows us to know their trading patterns and get the signal of the market stage. Assuming the whales reduce their holding when the price goes up, we can infer the top of the market is near, especially while the retail investors are still increasing their holdings at the same time.

How to Track Crypto Whales?

Because of the transparent nature of blockchain, we are able to track crypto whales. In theory, we can check the wallet address. Take Bitcoin, if a wallet address contains more than 1000 BTC, crypto enthusiasts will try to track the wallet's incoming or outgoing transactions. There are several types of crypto whales' wallet transactions:

- Exchange-to-wallet

For security reasons, crypto whales prefer to use cold wallets to store their crypto assets if they don't want to sell them in short term. So if they withdrew certain crypto assets from exchange to their own wallets indicates that the supply of these certain crypto assets is reduced. As a result, the price of these crypto-assets will increase. However, if crypto whales withdrew stable coins to their cold wallets indicates the market conditions are bad for investment, the crypto prices will drop.

- Wallet-to-exchange

Most people use centralized exchanges to trade. If a crypto whale transfers crypto assets to a known exchange wallet means the crypto whale has deposited crypto assets into their exchange account and plans to trade them soon. If there is a large sum of crypto assets such as BTC or ETH deposit to the exchanges' wallets means the whales are considering selling them to the market, it will put downward pressure on the market. However, if they deposit stablecoins. it may indicate an investment plan, which will put upward pressure on the market.

- Wallet-to-wallet

Crypto whales may transfer crypto assets from wallet to wallet, most of the time they are doing over-the-counter crypto trades. Reasons are for privacy and liquidity. OTC trades are untraceable most of the time, and the effects on the price are often not as prominent as regular trades.

We should notice that the transaction types above do not mean any 100% certainly outcomes. Because crypto whales also know the transactions are transparent, anyone can track them, so they may just move coins to trigger market reactions.

If we want to check crypto whales, we can use whale tracking tools:

- Coincarp Richlist and Coincarp Exchange Wallet Balance

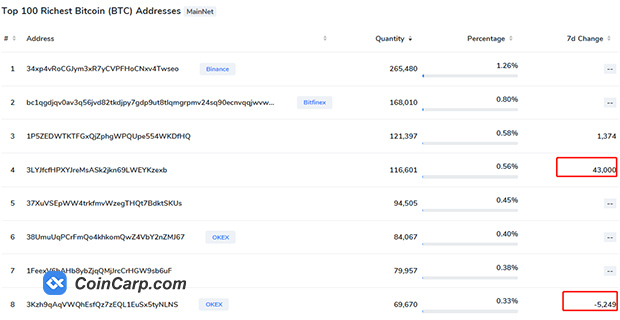

Take Bitcoin, for example, we can check the Top 100 Richest Bitcoin (BTC) Addresses on Coincarp, it shows the 100 richest addresses that hold Bitcoin quantity and 7 days change, we can get the changes of crypto whales' addresses.

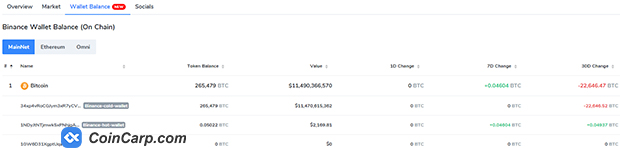

Also, we can check the exchanges' wallet balance (On Chain) on Coincarp, take Binance, for example, "Exchanges--Binance--Wallet Balance", the page shows us the "Binance Wallet Balance (On Chain)", if we click "Bitcoin", the web will show us the Bitcoin changes in the Binance exchange:

- Blockchain explorers

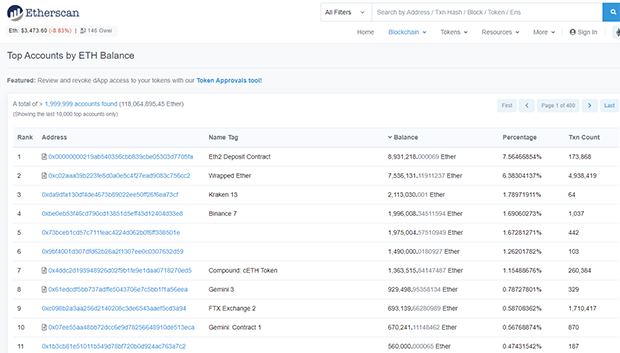

You can use Blockchain explorers to find the individual wallet addresses that have relatively fewer transactions but hold a large number of crypto assets, then you can see the exact amount of tokens that they have on the mainnet and the tokens they move recently. Moreover, if you use Etherscan, a blockchain explorer for the Ethereum blockchain, you can use the watchlist on Etherscan to set alerts in order to track transactions to and from a certain address.

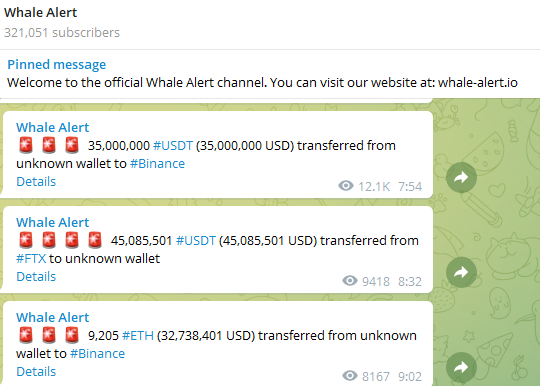

- Whale Alert

Whale Alert offers alert and tracking services that track large transactions across major blockchains and also tag known wallet addresses. You can join Whale Alert Twitter and Telegram communities to track crypto whale transactions in real-time.

Final Thoughts:

To track crypto whales is a good way to understand the market movements and know the patterns better. However, investors should not just rely on these methods and easily make decisions depending on the whales. Since the crypto market is lacking regulations, they can be manipulated easier than traditional financial markets, so you may gain some advantages by tracking whales, but it is not the most trustworthy information. You should consider a lot more information before making trading decisions.

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment