What's A Rug Pull in Crypto?

What Is A Rug Pull?

A lot of newbie in the crypto world may be heard of "Rug Pull" and have no idea what does this word mean. Just imagine that you are standing on a rug and someone pulls out of the rug off from you suddenly, certainly, you would fall on the floor! If you are holding something in your hands, it will also drop on the floor and you will lose everything. Similar to the scenes we describe, a crypto rug pull means the crypto project team ignores the project and runs away with the investors' assets.

How Does Crypto Rug Pull Work?

Basically, a crypto rug pull is orchestrated by a team with immoral intends. They will create a token and attract investors to buy in, while the investors have distributed certain amounts of capital, the creators will withdraw capital from the liquidity pool which makes the token price approximately zero. Generally, there are 3 types of rug pull:

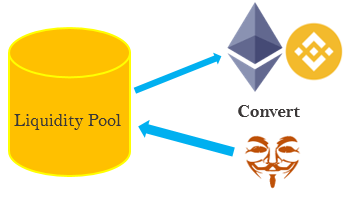

- Stealing liquidity. In this type of rug pull, the scammers will create a liquidity pool with their token and pair it with top cryptocurrencies such as ETH or BNB. They will provide a large number of tokens to the pool and attract people to swift the tokens with their ETH or BNB, which will be locked up in the liquidity pool for a period of time. The more investors swift the token, the price of the token increase, which results in more ETH or BNB added to the pool. At last, the creator will "pull" all the ETH or BNB from the liquidity pool, leaving worthless tokens to the investors.

- Manipulate with technical. The developer can write a few lines of code to make the investors unable to sell or spend the tokens. How can it happen? Because the developers can modify the ERC20 tokens' "approve" function that the buyers cannot sell or spend the tokens except the developers. So when the price of the token goes up, people try to sell them to earn a profit, they realized it is unable to sell. Then the developers can sell all the tokens and run away.

- Developers drain out shares. A lot of projects' teams claim their projects are worth to invest. However, some of the projects mean nothing but only aims to get investors money and run away. This kind of developer creates a project with a high-value proposition. They make a wonderful roadmap and promise the token features or platform will be released soon. In fact, there is nothing behind the project and the token is worthless. They will keep a huge part of these tokens for themselves. When investors believe in the projects' potential and buy-in, the price goes up. The developers will sell out their shares(do it at once or in a period of time). At last, the investors just hold worthless tokens.

Are Crypto Rug Pulls Illegal?

Because the crypto regulations in different countries are different. For some countries, the crypto rug pulls consider as financial crimes. However, some countries may not care about the rug pulls. Some crypto rug pulls are obviously, the team issue the token and sell them, then cash out, they run away and the website closed. However, most of the projects are not that obvious nowadays, when the price rises to a high point, then the big whales sell-off occurs and the value of the coin drops significantly. The developers can manipulate the price again and again. Because it is still in operation, so it is obviously legal but just immoral.

Why Crypto Rug Pulls Happen in DeFi?

DeFi means no central authority and just runs on smart contracts, everyone can list tokens on Decentralised Exchange(Dex) without audit. So the scammers can just create a token, promise the utility of the token and list them on Decentralised Exchange(Dex) such as Uniswap or Pancake. Then they use Telegram or Twitter to recruit investors to buy it. Once money flow to the project, the value of the token pulls up, creators sell these tokens and make the value of the tokens zero.

What Are the Famous Examples of Crypto Rug Pulls?

Squid game(SQUID) token is the latest rug pull which happened in November. It is the token inspired by the popular TV series Squid Game. The price of Squid tokens rose from $0.0007 to $2,861.8, the developers pull $3.4 million from 43,000 investors, then the token crashed to US$0.01 in just 5 min. Now the website and socials are no longer functional.

- Luna Yield

Luna Yield was a liquidity farming project on the Solana (SOL) platform. Three days later after its IDO(August 19, 2021), Luna Yield sent the funds, about $10 million that it raised to Tornado Cash so it could not be traced, and then it shut down its website as well as all of its social media accounts, nobody has been able to contact the Luna Yield team since.

- OneCoin

OneCoin is the famous Ponzi scheme in the crypto market. The developers of the project ran away with more than $4 billion from investors. OneCoin was never traded, neither could it be used to buy anything as it had no blockchain model or payment system.

How do I Know If My Rug is Pulling in Crypto?

There are some signs that may indicate a rug pull:

- Low liquidity. If a project which has low liquidity, which means you are unable to convert your tokens in a short time.

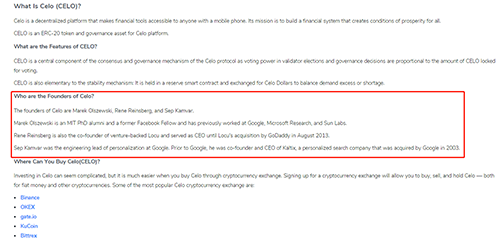

- Anonymous team founders. It is not certain, but investors should keep alarmed. Some founders who prefer to keep anonymous might avoid getting caught once they have cheated investors.

- No certain use case. Some projects creat a token that without any use case solution. However, they just focus on marketing to reach more people and simply sell the token.

- Price increase overnight. A normal project value grows based on demand and supply, the price grows stably in long term. However, a rug pull may have price skyrocketing.

How to Avoid Crypto Rug Pull?

If you want to invest in altcoins, you should do some research before buying them. Here are some tips about how to avoid crypto rug pull.

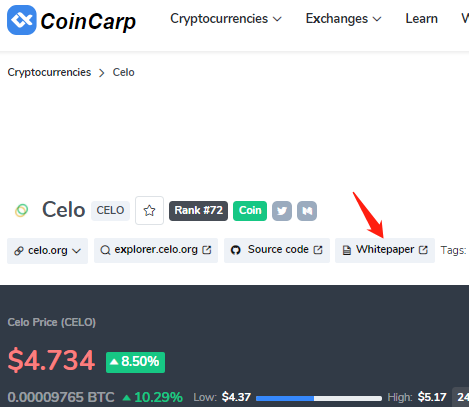

- Read the white paper and project information. Visit the project official sites or use Coincarp.com to search the crypto information. Find out the founders' information. In general, some scam projects have a vague description of the project.

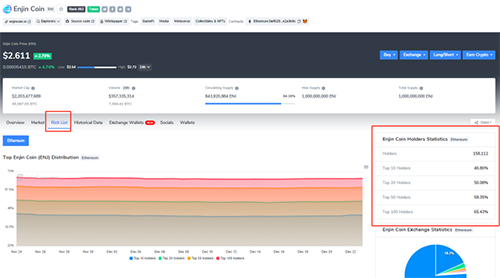

- Check the creators' holding. Check the rich list, find out what percentage of the token supply is controlled by the creators. If the creators have large percentage of the tokens, they can manipulate the market easily. A few wallet holders also mean more centralized control on the project. Richlist and Holders Statistics can be easily check on Coincarp.com.

- Check the project's code. Try to analyze the project's code for functions, an expert can find out the not safety lines of code.

Comments

Post a Comment