What Is Margin Trading in Crypto?

What Is Crypto Margin Trading?

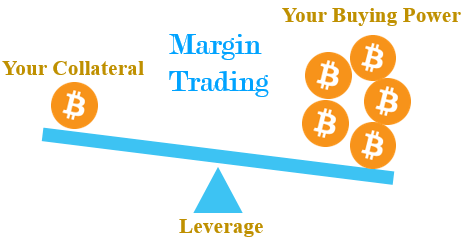

Margin trading is a trading strategy that trades with funds from a third party. Traders can borrow a great sum of assets to leverage their positions and largely amplify trading results to achieve large profits if the trade success. This strategy is quite popular in the traditional stock, international Forex, and commodity market. Now it is also widely used in cryptocurrency markets. In general, Crypto margin trading allows traders to borrow capital from other traders who earn interest from margin funds, or from the exchange(less common).

How Does Crypto Margin Trading Work?

When you went to make a crypto margin trade, you should deposit a small amount of capital, it is called "initial margin". A small amount of capital is used for borrowing a large capital to invest in the crypto market. So the "margin trading" also can be called "leverage trading". Leverage is defined as the ratio between browsing funds and margin. Different crypto exchanges set different leverage. The ratio usually ranges from 2:1 to 100:1. In general, people use the "x" terminology to represent the leverage ratio. For example, 20X means 20:1 leverage(so as 2x, 5x, 10x, 20x, 50x, etc.), so traders can open a position 20 times the value of their margin, if we want to open $100,000 trade, $5000 capital should be committed.

Is Crypto Margin Trading Risky?

Margin trading can result in much larger profits than just implementing the traditional investment strategy. Traders can create many positions with quite small amounts of funds. People are no longer to deposit a larger amount of crypto assets to the exchange accounts while using margin trading.

However, the risk of crypto margin trading can't be omitted. Obviously, the loss is the same as the gain. Different from spot market trading, the loss of margin trading sometimes can exceed the trader's initial assets. It is well-known as a high-risk trading strategy because a small change in crypto price can result in tremendous losses for investors. Even worse, if the market is suffering large fluctuations, forced liquidation by the exchange may happen. In order to control the risk, traders should use risk management tools to reduce the losses.

How Do I Short or Long a Bitcoin Margin?

Short a Bitcoin Margin

People may wonder is it possible to gain profits while the Bitcoin price is dropping. Well, it is possible while using the crypto margin method which is related to short a Bitcoin margin. "Short" means selling at a high price, then buying at a lower price to earn a profit from the price difference. This article will show you the method of how to short a Bitcoin margin. Let's take the Binance exchange, for example, assuming the Bitcoin price is now 10,000 BUSD and you believe the price will drop in the future, we can make the Bitcoin margin trading with the following processes:

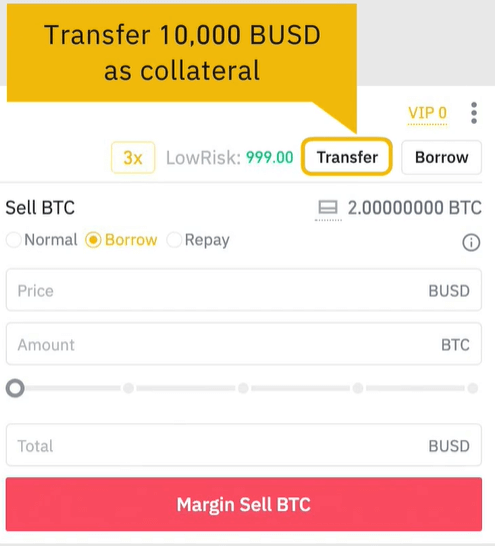

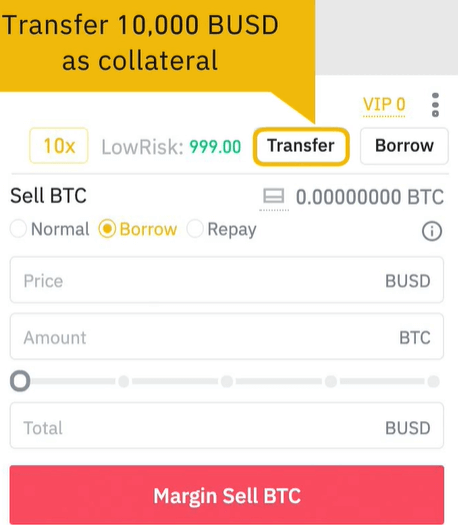

- Log in to the exchange, transfer 10,000 BUSD (you can use other stable coins that the exchanges supported) as collateral to your margin account.

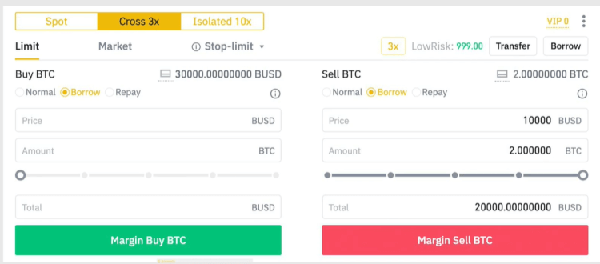

- On the BTC/BUSD trading page, under the cross 3x tab, select the limit order, click borrow, input 10,000, click "Margin Sell BTC". Then you would have borrowed 2 BTC if the order was complete.

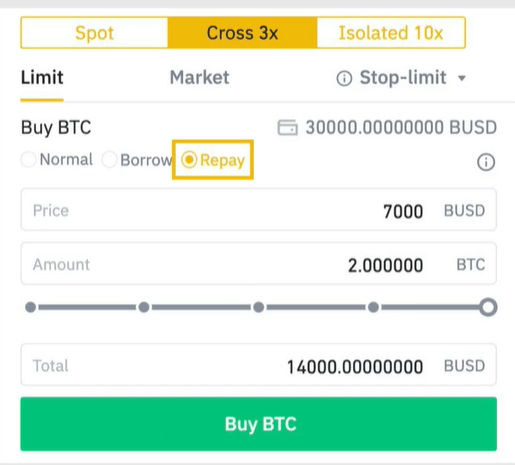

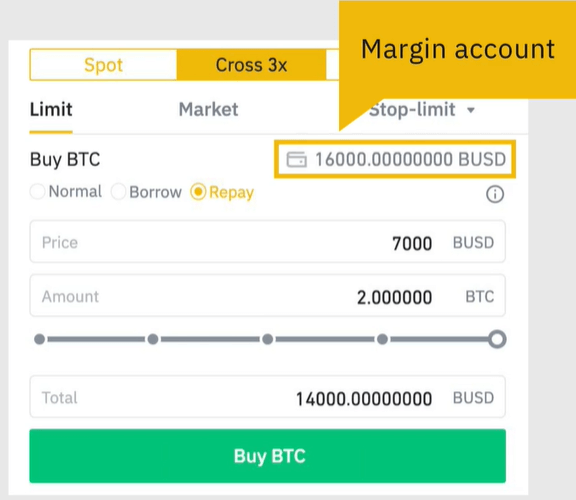

- If the BTC price goes down to 7,000 BUSD, you can use the "repay" function and buy 2 BTC at 7,000 BUSD each, then the 2 BTC you have borrowed will be refunded with 14,000 BUSD automatically.

- If not consider the trading fees, you would have 16000 BUSD in your margin account. It means you earn 6000 BUSD(16000-10000).

Long a Bitcoin Margin

"Long" refers to buying at a low price and then selling at a higher price. In this way, you can earn a profit from the price difference. Also, we take the same example, assuming the Bitcoin price is now 10,000 BUSD and use the Binance exchange. If you believe the Bitcoin price will increase in the future, you can do the long strategy. The processes are as follow:

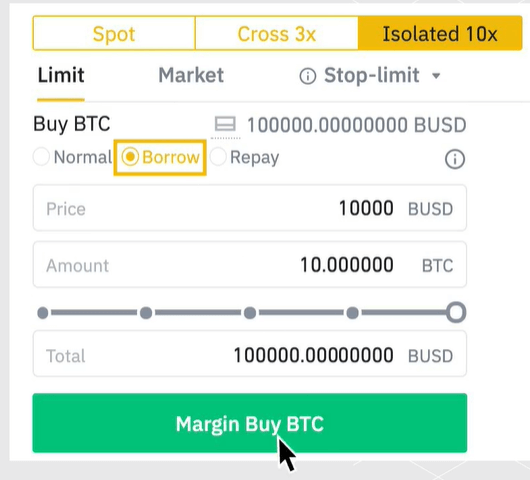

- Select "cross margin", transfer 10,000 BUSD as collateral

- Choose "Isolated 10x", select "Limit order ", click "Borrow", input"10,000", click "Margin Buy BTC". You would have borrow 90,000 BUSD and bought 10BTC at the price of 10,000 BUSD, once the order place successfully.

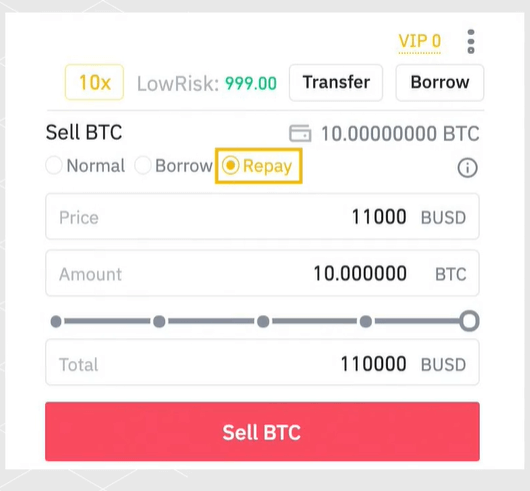

- If the BTC price goes up to 11,000 BUSD, you can use the "Repay" function, and sell 10BTC at 11,000 BUSD, the initial borrowed 9000 BUSD will be refund automatically

- If not consider the trading fees, you would have 20,000 BUSD in your "Isolated margin account"and earn 10,000 BUSD

(* Pictures and trading examples retrieved from Binance Suppot)

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment