What is a DAO?

DAO, or decentralized autonomous organization, is a blockchain-based form of limited liability company that is often governed by a native crypto token. Anyone who invest in these tokens has the power to vote on key DAO-related issues.

A DAO basically operates itself. Based on a set of rules that are enacted at the time of its inception and then modified over time by either stakeholders or an algorithm. It completes tasks using a series of "smart contracts," which differ from typical legal contracts in that they exist and operate independently over the internet without requiring manual human intervention. Despite this autonomy, some tasks, such as interactions with the legal system, cannot be completed by a DAO on its own. Moreover, a DAO can function outside of a typical organization's administrative structure because of its autonomous activity. Instead of top-down administration, each member has an equal say in the organization's actions, or all management can be handled by a computer program that is not under the authority of the founding party. In any instance, within the DAO, no single person or party makes choices.

Why DAOs?

DAOs offer significant benefits over traditional organizations since they are internet-native. The absence of trust required between two parties is a key benefit of DAOs. While a typical organization demands a great deal of faith in the people who run it — particularly on behalf of investors — DAOs just require trust in the code.

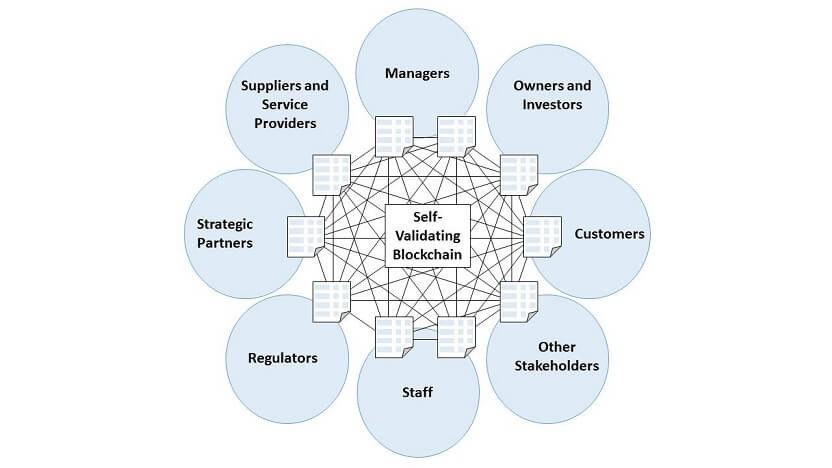

A blockchain records the financial transactions and regulations of a DAO. This eliminates the requirement for a third party in a financial transaction, allowing smart contracts to streamline those transactions. A smart contract determines the firmness of a DAO. The smart contract holds the Organization's storage and symbolizes the organization's regulations. Because DAOs are transparent and public, no one can change the rules without others noticing. Although we are accustomed to organizations with legal standing, a DAO can function very well without it since it may be constituted as a general partnership.

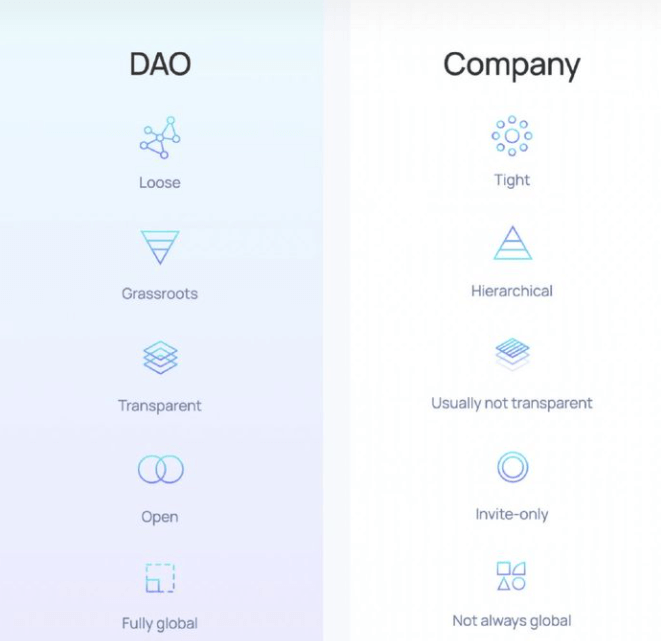

DAOs have a more democratic structure than regular corporations. Any modifications to a DAO must be voted on by all members, rather than being enacted by a single party (depending on the company's structure). The majority of DAO financing comes from token-based crowdsourcing. DAOs are governed by a set of rules. DAOs are governed by the community, whereas traditional firms are governed by CEOs, Boards of Directors, activist investors, and so forth. Traditional corporations' activities are private, with only the organization knowing what is going on, and they are not always worldwide, but DAOs' operations are totally transparent and global.

How does a DAO work?

A DAO, as previously stated, is an organization in which decisions are made from the ground up by a group of members. A DAO can be joined in a number of ways, the most common of which is through the ownership of a token.

DAOs operate using smart contracts, which are essentially chunks of code that automatically execute whenever a set of criteria are met. Smart contracts are currently used on a variety of blockchains, while Ethereum was the first to do so.

The DAO's regulations are established by these smart contracts. Those who own a share in a DAO are given voting rights and have the ability to influence how the company functions by voting on or proposing new governance ideas. This methodology protects DAOs from being inundated with suggestions by requiring that a proposal be approved by a majority of stakeholders. The method for determining that majority differs from DAO to DAO and is described in the smart contracts.

DAOs are completely self-contained and transparent. Anyone may see their code since they are built on open-source blockchains. Because the blockchain records all money transactions, anybody may audit their built-in treasuries.

Disadvantage of DAOs

DAO is a powerful way of organization, but aren’t perfect. They are not an ideal system for everything. Although DAO can replace all aspects of legal contracts with code and save a lot of operating expenses, in some cases, there is no legal protection beyond the rules outlined in the smart contract that promotes DAO. If the control of the DAO is concentrated or the definition is vague, this may cause problems, although some DAOs may also form legal entities behind the DAO itself. There is a Wyoming DAO bill passed by the Wyoming State Senate committee, which will help establish a legally recognized DAO.

Another problem is that due to such open membership, it may lead to lower quality in the DAO. While MIT shared its thoughts back in 2016 - revealed it considers it a bad idea to trust the masses with important financial decisions. The organization appears to have never changed its mind on DAOs — at not least publicly. The DAO hack also raised security concerns, as flaws in smart contracts can be hard to fix even after they are spotted.

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment