What Is Arbitrage Trading in Crypto?

What Is Crypto Arbitrage Trading?

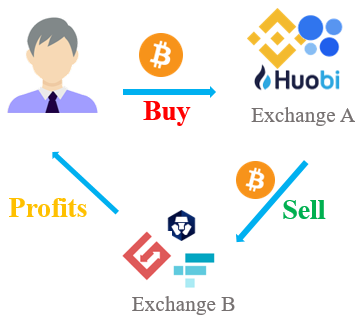

In general, crypto arbitrage trading is a trading technique that traders purchase one kind of cryptocurrency on one exchange and sell it on another simultaneously to earn profits.

Because there are thousands of crypto assets listed on hundreds of exchanges, the price of the same crypto assets may differ on different exchanges. So the traders have the opportunity to generate profit. It is similar to the traditional financial "arbitrage" strategy that takes the opportunity of an asset is selling at a low price in one market but high in another market.

The great challenge for arbitrage traders is they need to find out pricing differences and trade in a short time. Because the prices are changing quickly, so the chance of profitability usually ends very fast. However, since the prices have little difference, so the returns are generally low, which means they need to invest a large sum of money to make reasonable profits.

How Many Types of Arbitrage Trading Strategies?

- Spatial arbitrage: somebody may also call it "exchange arbitrage", it is the most common and simple way of arbitrage trading. It means buying one kind of cryptocurrency from one exchange and selling it in another exchange. Transferring cryptocurrency between exchanges to make profits. For different centralized exchanges, price discrepancies always exist, the trader will find and seize these discrepancies and make the crypto transfer. However, they will face the risk of transfer times and loss of trading fees. So the timing and precise calculation are important.

- Convergence arbitrage: Traders can go long one cryptocurrency on one exchange and short on another, then wait till the prices on the two exchanges converge and close both of the two positions. This type of arbitrage trading can avoid the risks of transfer costs and times.

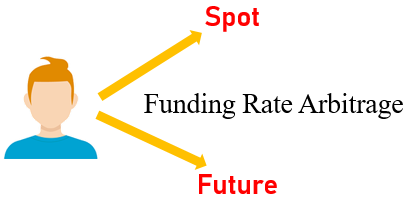

- Funding rate arbitrage: The funding rate is related to the perpetual futures contracts. The purpose of the funding rate is to ensure that futures prices and index prices converge regularly. When a perpetual futures contract is trading higher than the spot markets, long positions have to pay shorts due to a positive funding rate. In contrast, short positions pay longs while the futures price is trading below the index price. People tend to hold a long position than a short position. So the arbitrage opportunity is to hold a short position in the perpetual futures market and buy the same amount in the spot market, hedging total investment. If the funding rate for that contract pays you 2%, which means you can receive 2% for holding crypto assets without price risk.

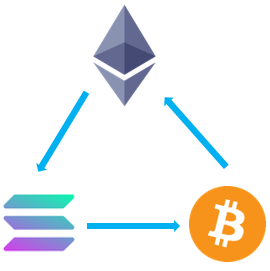

- Triangular Arbitrage: The price discrepancy among different cryptocurrency pairs always exists. So the triangular arbitrage traders will take this advantage to earn money. They can buy one cryptocurrency and then switch it for another which is undervalued compare to the first one on the same exchange. For example, you can purchase BTC with SOL, then use BTC to buy ETH, in the end, buy back SOL with ETH. If the value of ETH and BTC doesn't equal the value of each of those cryptocurrencies with SOL, there is an arbitrage opportunity.

- Quantitative Trading Arbitrage: It is also called Statistical Arbitrage. Based on quantitative analysis, with the implementation of mathematical models and bots, traders can profit from hundreds of trades in one minute automatically. In general, quantitative trading is used by financial institutions, the transactions are usually large and may involve the purchase and sale of thousands of cryptocurrencies. With modern technology, mathematics, and comprehensive databases, rational trading decisions can be made, and human Irrational decisions can be avoided.

Is Arbitrage Legal in Crypto?

Arbitrage is the process of discovering price discrepancies of the same or similar crypto assets in different markets, aiming to generate low-risk profits. Arbitrageurs can provide liquidity in different markets and contribute to market efficiency. So it is legal and be encouraged by the exchanges.

How Do You Do Arbitrage Trading in Crypto?

Take common spatial arbitrage and funding rate arbitrage for example:

- Spatial arbitrage: If you want to make spatial arbitrage, the first thing is you should find out the crypto prices in different exchanges, it is not an easy thing. Besides, you should consider the trading speed since you are facing a volatile market. So it is better to trade on high liquidity exchanges. Nowadays, seldom people make spatial arbitrage in manual. Most of the investors use the crypto arbitrage bot to execute the trading. The bot is a computer program that will compare prices in different exchanges and make trades automatically to get profits through price discrepancies. Also, someone will search for the less popular cryptos to trade, because it is less popular, so the price will change rapidly. Some may take the risk to buy and sell across exchanges.

- Funding rate arbitrage: To make it easy to understand, we can call it Spot-Futures Arbitrage. Let's make an assumption to explain how to make spot-futures arbitrage: If you have 20000 USDT and the bitcoin's price is 20000 USDT, you can separate it into half, 10000 USDT to buy 0.5BTC in the spot market and short 0.5BTC in the perpetual futures market with your 10000 USDT. Then you will get 5USDT if the current funding rate is 0.05%(0.5*20000*0.05%=5USDT). Combining the leverage in the perpetual futures, traders may earn more profits.

What Are the Risks Related to Arbitrage Trading?

Although arbitrage trading strategies are considered low risk, the risk can't be omitted. Arbitrage trading risks conclude the execution risk, trading volumes risk, cost risk, fraud risk, etc.

- Execution risk. When making crypto transfers across exchanges, you should execute the trades quickly to seize the price advantage. If not complete the trading in a short time, the crypto prices between exchanges may reach the same and you may get zero or negative returns.

- Trading volumes risk. Some exchanges may have low trading volume, which means they don't have adequate liquidity for you to sell or buy. Then you are unable to complete the arbitrage trading.

- Cost risk. You may need to consider the trading fee, withdrawal fee in different markets and calculate them carefully. Sometimes the fee may change when the crypto market develops. If the fee rates increase, you may get negative returns.

- Fraud risk. Some fraud such as fake exchange, fake projects which claim you can get high arbitrage trading returns exists in the crypto world.

Comments

Post a Comment