How to Borrow Crypto with DeFi?

In the article "What is DeFi?", we have explained the definition of DeFi and the application of DeFi. Now, this article will extend the topic of DeFi Borrowing and Lending.

What is DeFi Lending?

DeFi lending, or DeFi crypto loans, means people can borrow cryptocurrencies (generally stable coins or fiat) from a decentralized financial platform by locking crypto assets without intermediaries. In general, the interest rate is lower than a traditional financial platform. Meanwhile, the lender can gain interest(earn coins) when lending the crypto to the borrowers.

How DeFi Lending Works? How to Borrow Crypto with DeFi?

In the crypto world, new projects are launching every day, the crypto price may increase or decrease sharply. Some crypto investors are eager to take risks to invest in different kinds of projects. If they want to invest, cash flow is vital, so they will try to borrow money from a financial platform. However, some investors take a conservative strategy by holding crypto assets, the problem is, just holding the crypto will not make any extra earning. So the DeFi lending can solve all these problems. They can lend the crypto to someone else and earn interest on the DeFi Lending platform through a smart contract.

The borrower needs to offer something more valuable than the loan amount, generally the crypto assets. The smart contract of the DeFi platform will automatically calculate the amount of crypto you can loan by the value of the crypto assets that you collateral. If the collateral price drop below the loan price, it will come to liquidation, which means the borrower will no longer get the collateral back.

What Are the Difference Between DeFi Lending and Traditional Lending?

If we want to apply for a loan from a traditional financial organization(such as a bank), generally, you need to collateral some physical assets, such as a car or house, and show your Id certification. Then you need to sign a document and wait for the financial organization to approve your application.

When comes to decentralized finance lending, there is no need to apply from an intermediary financial organization. It is basically peer-to-peer trading, smart contracts will be self-executive and make the lending succeed. The borrowers will not need to sign paper documents or collateral physical assets, they just collateral crypto assets and the protocol will lock the assets. Then the loan will transfer to the borrowers' address automatically.

Compare to traditional lending, DeFi lending enjoys the following advantages:

- Each process is totally transparency, users can access the assets easily without third-party.

- The procedure is more direct than traditional lending.

- No censorship, users do not need to provide credit certification.

- In general, DeFi Lending has a lower rate than centralize financial organizations.

Why People Borrow from DeFi?

- To get liquidity: people don't need to sell the crypto to get a loan.

- Fast speed: with blockchain technology and AI, applications can calculate the optimum loan terms and risk factors automatically and speed up the examinations. When the loan is approved, lenders can get the crypto in time.

- Lower interest rates: take Compound Finance, for example, the interest rate is as low as 5%. But bank loan interests may be higher than 10%.

How Do I Borrow Assets From Compound?

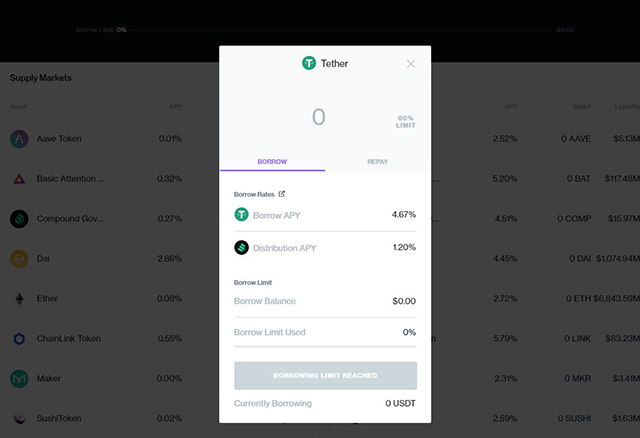

There are many popular DeFi platforms that allow users to borrow crypto, Compound Finance is one of the most popular platforms. We will take Compound as an example to show you how to borrow crypto from DeFi.

- Connect your wallet first. ( Don't have a wallet? choose one from the Coincarp wallet rank page, click here)

- First, click on the asset that you'd like to Borrow.

- A pop-up will appear, displaying the Borrow APY (amount of token/year) you'll pay, and the Distribution APY (amount of COMP/year) you'll earn by Borrowing the asset.

- To Borrow an asset, type the quantity you'd like to borrow at the top of the pop-up. For convenience, the 80% LIMIT button will borrow up to 80% of your Borrow Limit. The impact on your Borrow Limit meter will be displayed.

- Click Borrow, and submit the transaction.

Is DeFi Lending Safe?

Though there are many advantages in DeFi lending to traditional finance, there are a number of associated risks that cannot be omitted.

- Impermanent loss: when the assets are locked up in the liquidity pool, if the assets' price changes, an unrealized loss will happen.

- Flash loan attacks: there is an uncollateralized lending protocol in some DeFi lending platforms that allow people to borrow hundreds of thousands of dollars in crypto assets without any collateral. But people have to pay back in full amount in a few seconds. Flash loan attacks will borrow huge sums of money with flash loans and use them to manipulate the market or develop vulnerable DeFi protocols for their own personal gain.

- DeFi rug pulls, some scammers will create a new token, then pair it to a popular cryptocurrency such as Tether. They will encourage people to deposit the new token to the pool with extremely high yields commitment. When the pool has a certain number of the popular cryptocurrency, they will mint millions of new coins to swift for the popular cryptocurrency and leaves millions of worthless coins in it.

Comments

Post a Comment