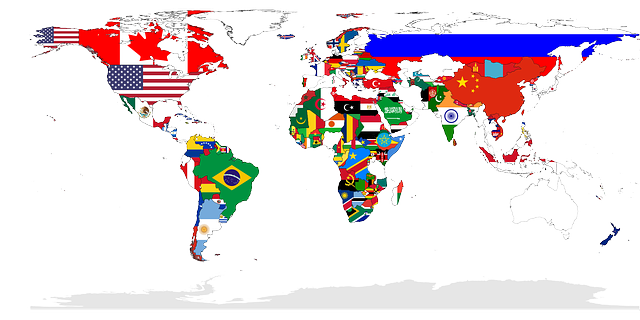

What Are the Cryptocurrency Regulations Around The World?

Since the creation of Bitcoin in 2008, the legal issue of cryptocurrency has been discussed for years. The government attitudes toward cryptocurrency in different countries are various. They are mainly divided into support, opposition, and neutral. Most of the countries which support cryptocurrency believe digital assets are just one kind of property that will not do any harm to the economy if they are under the regulation of the government. However, the countries which take boycott opinions believe cryptocurrency such as bitcoin will pose an economic risk. Moreover, they may become the assistance for criminals, such as financial scams, money laundering, terrorism, dodging taxes, drug dealing, and so on.

In order to get you to know about the various legislative positions towards cryptocurrencies around the globe. This article will introduce the current cryptocurrency regulatory landscape by some main countries.

United States of America: No Clear Regulatory Framework

Since each state in the United States has its own law, so regulation varies by state. At the federal level, there is no clear regulatory framework. Different departments have various explanations for cryptocurrency. For example, the Securities and Exchange Commission (SEC) views cryptocurrency as a security, while the Commodity Futures Trading Commission (CFTC) takes Bitcoin as a commodity, and the Treasury calls it a currency. However, the Financial Crimes Enforcement Network (FinCEN) does not accept cryptocurrencies to be legal tender but considers cryptocurrencies are "other value that substitutes for currency". They also claim that cryptocurrency exchanges in the United States must register with the FinCEN.

Cryptocurrency exchanges are legal in the United States and should be under the regulation of the Bank Secrecy Act (BSA). So if you want to register an exchange in the US, you should get a license from FinCEN and comply with anti-money laundering (AML) and combating the financing of terrorism (CFT) obligations. In a word, cryptocurrency exchanges are in the same regulatory category as traditional AML/CFT gatekeepers, financial institutions, and money transmitters. As for the Internal Revenue Service (IRS), they classify cryptocurrencies as property for federal income tax purposes.

In conclusion, the US continues to make progress in developing cryptocurrency legislation. Nowadays, Cryptocurrencies are still controversial in the definition and they are not considered legal tender. Exchanges are legal and regulation are not the same in different states.

Canada: Positive Attitude Toward Cryptocurrency

Canada is the first country to approve AML-related regulation of cryptocurrency service providers. According to the Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC), crypto trading platforms and dealers in the country must register with regulators, which means exchanges are legal in Canada. Canadaclassify crypto-related financial firms as money service businesses (MSBs) and requires that they register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). Cryptocurrencies can be used to buy goods and services online or offline stores as long as they accept them, although the government did not treat them as legal tender.

Mexico: Not Money, Warns of Risks

Mexican financial authorities said that cryptocurrencies are not legal tender in Mexico and are not considered currencies under current laws, warning that financial institutions that operate with them are subject to sanctions. They claim that cryptocurrency acceptance as a means of payment is limited and they are not a good reserve or value reference. Also, the crypto companies are to report any transactions exceeding the $87,000 (~£63,850) threshold and the authorities did caution that companies offering operations in cryptocurrencies would be subject to sanctions.

Brazil: No Regulations or Legislation on Cryptocurrency

There are no regulations or specific laws on cryptocurrency in Brazil. However, according to the Decree-Law 857-69 and Law 10192/01, the Brazilian real is the country's legal currency. Cryptocurrencies can be considered assets in Brazil. Initial Coin Offerings (ICO) may be subject to the Capital Markets Law and the Brazilian Securities Exchange Commission (CVM) regulatory framework. No anti-money laundering regime specific to cryptocurrency in Brazil. As for the tax, the income of selling cryptocurrency must be declared in income tax statements.

Argentina: A Regional Leader in Crypto

Cryptocurrencies are legal in Argentina. Moreover, the regulation specific on cryptocurrency of anti-money laundering, taxation, anti-financing of terrorism has been issued by the Argentina government. However, they have not implemented specific regulations on the issuance, exchange, use of cryptocurrencies. As a matter of fact, cryptocurrencies in Argentina are defined by the Financial Information Unit (UIF) as a digital representation of value that can be digitally traded and functions as a medium of exchange but does not have the legal tender or guaranteed by any government.

Chile: No Regulations on Cryptocurrency

Although the Central Bank of Chile has claimed that cryptocurrencies are neither legal tender money nor a foreign currency, there is no regulatory regime that governs the use of cryptocurrencies. Obviously, cryptocurrencies are in wide use in Chile.

European Union: Legal, But Vary by Member-state

Cryptocurrency is legal throughout most of the European Union (EU), but cryptocurrency exchange regulations depend on individual member states. Cryptocurrency taxation also varies but many member-states charge capital gains tax on cryptocurrency-derived profits at rates of 0-50%. Cryptocurrencies are classified as qualified financial instruments (QFI's). However, the EU's Fifth and Sixth Anti-Money Laundering Directives (5AMLD and 6AMLD) have come into effect, which will tighten the KYC/CFT obligations and standard reporting requirements.

Russia: Legal to Mine

The law prohibits exchange operations with cryptocurrency in Russian. However, Vladimir Putin said Russia accepts the role of cryptocurrencies, and that cryptocurrencies can be used for payment. As of November 2016, bitcoins were "not illegal" according to the Federal Tax Service of Russia. Deputy Finance Minister of the Russian Federation Alexei Moiseev said in September 2017 it's "probably illegal" to accept cryptocurrency payments.

United Kingdom: Cryptocurrency is Property

The UK has confirmed in 2020 that crypto assets are property but there are still has no specific cryptocurrency laws and cryptocurrencies are not considered legal tender. The FCA and the Bank of England have issued a range of warnings and guidance about the absence of regulatory and monetary protection, such as the status of cryptocurrencies as stores of value, and the dangers of speculative trading and volatility. Also, exchanges should be registered with the Financial Conduct Authority (FCA) in the UK.

Switzerland: Friendly to Cryptocurrencies

Cryptocurrencies are classified as assets or property and are legal in Switzerland. Digital assets exchanges and platforms are considered financial institutions in Sweden and must follow the local AML/CTF and consumer protection obligations. Switzerland's parliament passed the Blockchain Act in September 2020, further defining the legalities of shifting cryptocurrencies and operating cryptocurrency exchanges in Swiss Law.

Malta: Progressive to Cryptocurrencies

Malta is now among global leaders in terms of favorable regulation on cryptocurrency. Cryptocurrencies are not yet legal tender in Malta but are recognized by the government as a medium of exchange, a unit of account, and a store of value. The Maltese government has already enacted a trio of acts related to digital assets: MDIA, ITAS, and VFA, along with other blockchain-related legislation. No doubt that cryptocurrency exchanges are legal in Malta.

Estonia: Open and Innovative towards Cryptocurrencies

Estonia's government classifies cryptocurrencies as digital assets for tax purposes but does not subject them to VAT. In 2017, the Anti Money Laundering and Terrorism Finance Act introduced robust new regulations for crypto businesses operating in Estonia. Cryptocurrency exchanges are legal in Estonia and should follow the AML/CFT legislation.

Australia: Progressive in Cryptocurrencies Regulation

Australian government takes a relatively proactive stance toward crypto regulation and classifies cryptocurrencies as legal property, subject to Capital Gains Tax (CGT). Exchanges are legal in Australia and should register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and meet specific AML/CTF obligations. However, privacy coins are forbidden to be listed in Australian exchanges.

China: Bans Crypto Exchanges and Crypto Mining

China doesn't class cryptocurrencies as legal tender. In early 2013, The People's Bank of China (PBOC) banned financial institutions from handling Bitcoin transactions. Then in 2017, ICOs and domestic cryptocurrency exchanges were banned. Then in May 2021, Bitcoin mining was banned by the local government. Furthermore, China has declared clearly that crypto exchanges and crypto trading are illegal. The PBOC said it has also improved its systems to step up monitoring of crypto-related transactions and root out speculative investing. The PBOC also ordered banks and nonbank payment institutions not to provide services related to crypto.

Japan: A Progressive Approach to Crypto Regulations

Under the Payment Services Act (PSA) in Japan, cryptocurrencies are classed as legal property. Crypto exchanges in Japan are required to be registered and comply with AML/CFT obligations. The government in Japan treats trading gains generated from cryptocurrency as "miscellaneous income" and taxes investors accordingly.

South Korea: Crypto Transaction Tax-Free

Cryptocurrencies are not considered as legal tender or financial assets in South Korea. In this case, cryptocurrency transactions are currently tax-free. The cryptocurrency exchanges are Legal and must register with The South Korean Financial Supervisory Service (FSS), they must be subject to strict AML/CFT obligations.

Singapore: Cryptocurrency Exchanges and Trading are Legal

Singapore classifies cryptocurrency as property but not legal tender. So, Singapore's tax authority applies Goods and Services Tax on Cryptocurrency. The country's Monetary Authority of Singapore (MAS) licenses and regulates exchanges as outlined in the Payment Services Act (PSA). Cryptocurrencies in Singapore are subject to the same AML and CFT measures as traditional fiat currencies.

India: Regulations Remain Uncertain

In 2018, the Reserve Bank of India (RBI) banned financial institutions from transacting in virtual currencies but Supreme Court reversed this decision. However, India proposed a law that would make it illegal to issue, hold, mine, and trade cryptocurrencies other than state-backed digital assets in early 2021.

HongKong, China: Crypto as Virtual Commodity

Cryptocurrencies are not regulated by Hong Kong's financial regulators. The Hong Kong Monetary Authority (HKMA) has said that it does not regulate cryptocurrencies such as Bitcoin which it regards as a virtual "commodity" and not as legal tender, or a means of payment or money. Hong Kong regulates entities conducting activities in cryptocurrencies where the relevant cryptocurrencies are "securities" or "futures contracts" as defined in Hong Kong's Securities and Futures Ordinance (SFO). Intermediaries conducting regulated activities in relation to cryptocurrencies that are securities or futures contracts are required to be licensed or registered by Hong Kong's Securities and Futures Commission (SFC) and must comply with the anti-money laundering (AML) and counter-terrorist financing (CTF) requirements of Hong Kong’s Anti-Money Laundering and Counter-Terrorist Financing Ordinance (the AMLO).

Vietnam: Illegal as Payment Tool

The State Bank of Vietnam has declared that the issuance, supply, and use of cryptocurrencies are illegal as a means of payment. However, the government doesn't ban crypto trading as virtual goods or assets.

Turkey: Crypto Investment is Legal But not Payments

Cryptocurrency has been deemed to be a commodity (and not currencies) under Turkey regulations, payments in the asset are no longer legal. It is legitimate for retail investors to buy, sell and own crypto in Turkey. The Capital Markets Board (CMB) has emphasized that cryptocurrency/assets do not have a legal basis in Turkey and the transactions carried out are not under the guarantee of any public authority.

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment