What Are the Top 10 NFT Marketplaces?

NFTs (Non-Fungible Tokens) are having their big-bang moment: In early 2021, NFTs has attracted NBA superstar, Kevin Durant, Grammy Award winner, The Weeknd, famous Japanese artist Takashi Murakami, American Legend Pictures, Adobe Photoshop, to participate. It became so popular that even The New York Times and Time Magazine make a report of it.

It also attracts more and more venture capital firms to invest in NFT marketplaces, with the increasing number of NFT participants. For example, the NFT trading platform OpenSea received $23 million from Internet venture capital A16Z, and the NFT development team Dapper Labs received US$305 million from Jordan and Durant.

According to data from Cryptoart.io, the current total value of crypto artwork exceeds US490$ million, and the total number of crypto artwork pieces sold exceeds 170,000. In March 2021 the total transaction volume of the encrypted art platform exceeded a record high of US$200 million,

With the popularity of NFTs, various types of unique marketplaces have been established in recent years. How to choose a suitable marketplace to buy or sell crypto artwork seems to be a big problem for newcomers. This article will list the Top 10 NFT Marketplaces as references:

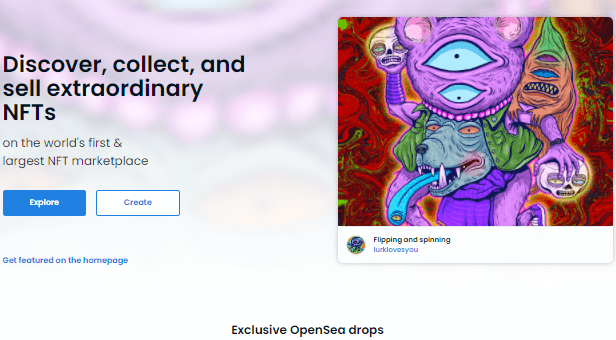

1.Opensea: Largest NFT Trading Platform

OpenSea is currently the largest NFT trading platform, covering digital art, encrypted collectibles, game items, virtual land, domain names, and other subdivisions.

In May 2018, OpenSea completed a $2 million seed round of financing, with investors including Blockchain Capital, 1confirmation, Founders Fund, Foundation Capital Chernin Group, Coinbase Ventures, Blockstack, and Stable Fund;

In March 2021, OpenSea received $23 million in Series A financing led by a16z, with the participation of the Cultural Leadership Fund. In addition, many angel investors including Ron Conway, Mark Cuban, Tim Ferriss, Belinda Johnson, Naval Ravikant, and Ben Silberman also participated in this round of investment.

Compared with other NFT trading platforms, OpenSea is more "friendly to the people". Anyone can create and sell NFTs for free, and there is no need to pay any gas fees when selling. However, a gas fee must be paid when the OpenSea account is used for the first time or after the product is sold.

When the creator successfully mints the NFT without the gas fee, OpenSea will charge a commission of 2.5% after successfully selling the NFT, and some game developers will charge 7.5% of the total transaction fee. The creator can set the copyright fee for the secondary sale of the product by himself, and the developer or creator can receive the secondary income every two weeks. In the future, with the automatic execution of this process, they will receive immediate income.

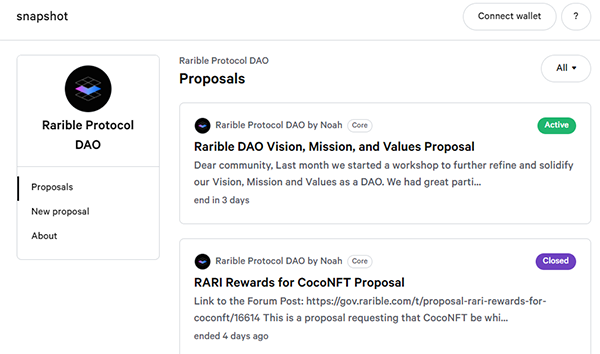

2.Rarible: Decentralized, Community, NFT Marketplace

Rarible is a community-driven, open-source, non-custodial platform that allows any user to create and display their own works, but Rarible owns the ownership of the NFT.

In 2021, Rarible has completed a seed round of USD 1.75 million. Investors include 1kx, Coinbase Ventures, ParafiCapital, CoinFund, etc.

Compared to other trading platforms, Rarible is more decentralized. In 2020, Rarible issued the governance token RARI. The tokens have greatly improved the sales process and sales conditions. Through the "transaction is mining" concept, the transaction volume of Rarible has been greatly increased. In addition to Rarible issuing RARI token rewards to platform traders every week, it also allows the most active creators and collectors of the platform to vote for platform upgrades through its governance token, they can also participate in platform management and artwork review.

Rarible's minting fees are borne by the creators, and the royalties(10%, 20%, and 30%) are also set by the creators. Rarible will charge a 2.5% service fee in the first sale.

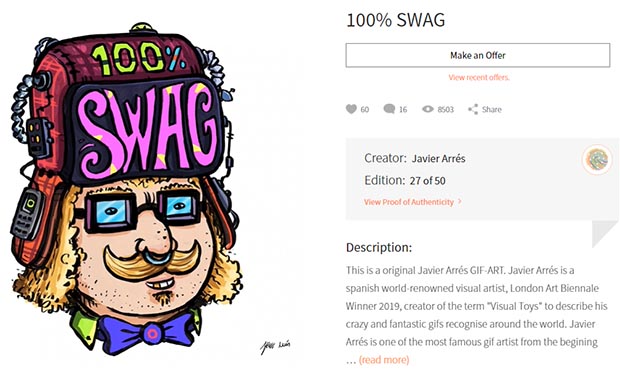

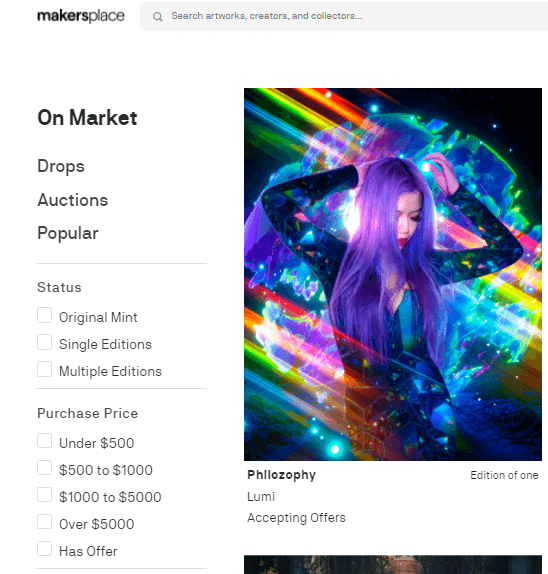

3.MakersPlace: Encrypted Artworks NFT Marketplace

MakersPlace is an encrypted art platform established in 2019. In April 2019, MakersPlace announced the completion of a $2 million seed round led by private equity fund Uncork Capital. Participants include Abstract Ventures, Draper Dragon Fund, Pinterest, Coinbase, Facebook, and Zillow.

MakersPlace strictly controls the quality of encrypted artworks, and currently only accepts invitations (you can also try to apply). MakersPlace will generate blockchain fingerprints of creators for each NFT work to prove the source and identity of the artwork, which makes it a unique symbol. Even if the work is copied, there will not be a true original signed version.

For creators, MakersPlace is also a low-threshold platform. You only need to provide a photo, and MakersPlace can generate ERC-20 tokens for them to trade. However, although MakersPlace is free to use, all transaction fees must be paid by the creator or collector.

In order to make creators more intuitively know the popularity of their own works, MakersPlace developed social functions, and creators can analyze the data from the number of "views" and "likes". At the same time, MakersPlace also provides each creator with a unique digital wallet to store their own artworks.

When a creator sells an artwork, MakersPlace will charge 15% of the sale price as commission. Also, they will charge 5% of the royalties as a service fee for each secondary sale, so the creator will receive 10% of the royalties. Of course, whether it is the first or second sale, any goods sold through a credit card will be paid an additional 2.9% to the platform.

Currently, MakersPlace accepts credit card, Paypal, and Ethereum payments.

4.Foundation: Invitation-based NFT Art Platform

Unlike other platforms under the "application review system", Foundation is an invitation-based NFT art platform, only the artworks of invited artists can be listed.

The Foundation is built as a community-led platform, they invite 50 artists to join the community, and then send 2 invitation codes to each artist. When the invited artist successfully sells an original artwork on the platform, they will get two invitations and can invite newcomers. And if the invitee also successfully sells the first work, he or she will also get 2 invitation codes. However. if an artist maliciously buys and sells invitation codes, their permanent residency qualifications will be deprived.

In addition to peer-to-peer invitations, "Community Upvote" is a new way to join in. After joining the "Community Upvote", all community members certified by Twitter can get 5 votes to support 5 artists that can be invited to join in, and the top 50 artists can join in and create NFT. However, in the future, Foundation may use "Community Upvote" as the main channel for creators to join in.

Apart from the special invitation mechanism, Foundation's sales mechanism is also special. The artist needs to set a reserve price when uploading an artwork. After the first bid, the work will be available for a 24-hour auction automatically.

The NFT generated on the Foundation will be automatically issued on OpenSea, and it will charge a 15% service fee after the work is successfully sold. In the second sale, Foundation charges a 10% service fee, and creators can get 10% as royalties forever, OpenSea will transfer once every 1-2 weeks.

5.SuperRare: Social Network Platform

SuperRare is a social network platform for art creators and collectors. With the smart contract, the platform support artists to publish limited-edition digital art collections that can be tracked on the chain, which makes them rare, verifiable, and worth collecting.

In March 2021, SuperRare completed $9 million in Series A financing. The investors were led by VelvetSea and 1confirmation, followed by MarkCuban, Chamath Palihapitiya, and MarcBenioff.

SuperRare has strict standards for artists. Artists who want to be admitted to SuperRare must apply to the platform first. Only original authors who pass the approval can sell NFTs. At the same time, SuperRare also censors artists once a week.

Of course, under high stringent requirements, SuperRare also has a good incentive mechanism for crypto artists. Regardless of the initial price, artists can receive 10% of each transaction price as royalties.

SuperRare will charge a 15% commission for the first sale and 3% for the second sale (paid by the buyer).

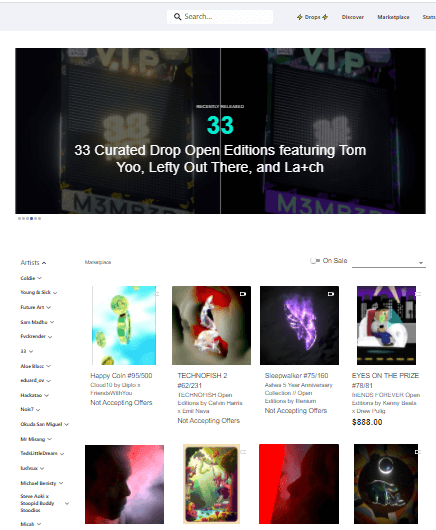

6.Nifty Gateway: Support Fiat Trading

Nifty Gateway is an NFT trading platform supported by Gemini Exchange, founded by twin brothers Duncan Cock Foster and Griffin Cock Foster. In addition to supporting cryptocurrency, Nifty Gateway also provides fiat money deposit channels. Users can purchase NFTs through credit or debit cards and withdrew them directly into their bank accounts when they are sold. Currently, Nifty Gateway only allows U.S. users to withdraw fiat currency, international users will be supported in the future.

According to Cryptoart.io, in March 2021, Nifty Gateway's transaction volume exceeded 140 million U.S. dollars. The rise of Nifty Gateway is largely due to its collaboration with artists, it even has a dedicated index for encrypted artists on its official website. At the same time, Nifty Gateway also has invited famous encryption artists such as Beeple, FEWOCiOUS, Jones, etc., and it will cooperate with celebrities to issue exclusive NFTs about every three weeks. Of course, other artists can also apply for the issuance of NFT through the official website. In the process of creator sales, Nifty Gateway charges a 5% sales fee for the first sale and also charges 5% for the second sale, plus a service fee of $0.3 USD.

For collectors, they only need to complete the email registration to join on Nifty Gateway, and the platform does not charge any gas fees, only 10% of the bid amount will be charged when using credit card transactions; for creators, Nifty Gateway requires artists to submit a short video introduction and their long-term goals when applying.

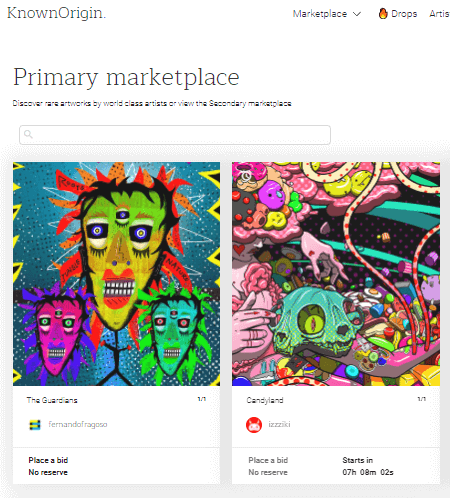

7.KnownOrigin: Friendly to Artists

KnownOrigin is an artist-driven NFT Art Marketplace. Due to its unlimited model, a large number of artists have applied for it. Currently, it has suspended applications. KnownOrigin's investor is BlockRocket, a European blockchain development laboratory.

According to KnownOrigin's regulations, a creator can upload 1 piece of artwork every 24 hours after the application is successful. When the work is sold for the first time, KnownOrigin will charge a 15% service fee, in the second sale, the platform will charge a 2.5% service fee, the creator will get 12.5% of the income, and the seller Get 85% of income. If the creator cooperates with other artists, he can pre-set the percentage of each sale during the NFT casting, such as 10%, 25%, 50%, etc.

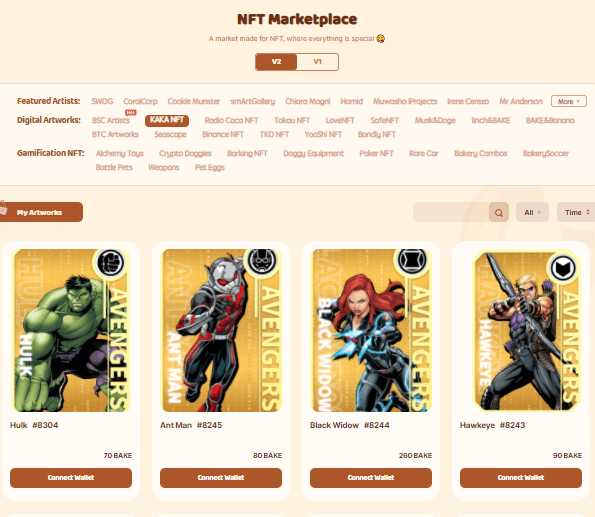

8.BakerySwap: Marketplace Based on Binance Smart Chain

BakerySwap has its own native token BAKE which works on Binance Smart Chain and supports BEP-20 token. It is a kind of open-source Defi Protocol like Uniswap. This Marketplace supports digital art, memes, games, and rewards users with BAKE Token Minting. Its NFT supermarket hosts digital art, meme competitions, and NFT in games that users can pay for in BAKE tokens. You can use NFTs in 'combo meals' to earn bonus BAKE tokens.

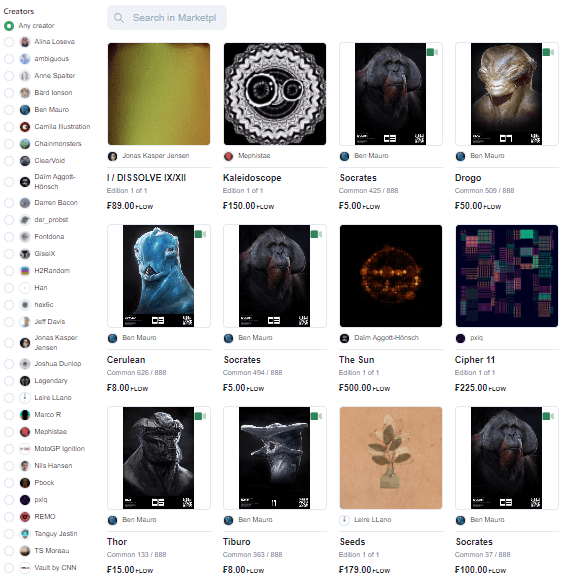

9.VIV3: NFT Market on Flow

VIV3 is the comprehensive NFT market on Flow, one of its most notable features is composability.

On VIV3, all the works of each creator are minting by their own blockchain smart contracts. Under this mechanism, any application in the Flow ecosystem can be directly integrated with the contracts of various artists without affecting the entire market pool. This allows countless new use cases to be built on a single asset or collection.

Creators can mint NFTs on VIV3 without gas fees, and VIV3 charges a 12.5% service fee charged on the first and second sales. In addition to 87.5% of revenue, creators can also receive 10% as royalties.

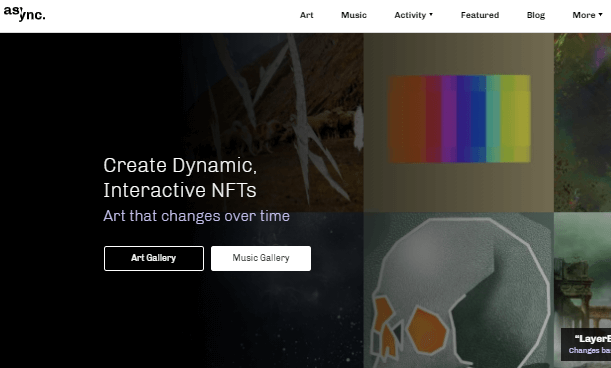

10.Async Art: Art Platform Built on Ethereum

Async Art is a programmable encryption art platform built on Ethereum. In February 2021, Async Art announced that it had received USD 2 million in seed funding, led by Lemniscap. Other investors include Galaxy Interactive, Signum Growth Capital, Sexy, Blue Wire Capital, Collab+Currency, Inflection, Divergence Ventures, The LAO, and Placeholder.

Async Art's work is composed of two parts: "Master" and "Layer". Master is the main form of the work. A Master can be composed of multiple layers. Async Art allows artworks to change according to "layer changes".

After applying to become an Async artist, the creator does not need any programming knowledge, just cuts the work into layers during the upload process. In the sale of works, creators can set "Buy Now" or "Auction", and the auction end time is determined by themselves.

Async Art will charge a 10% service fee for the first sale, a 1% service fee will be charged for the second sale. Of course, creators can also get 10% royalties. However, for custom artwork, Async Art will charge 20-30% of the service fee, and creators will receive 70%-80% of the income.

Follow us at: https://www.coincarp.com/learns/

Comments

Post a Comment